Alright, let’s break down something crucial—real estate commissions. If you’re buying or selling a home in California, you need to know where your money’s going. In 2024, new rules came into play to make these fees more transparent. This means you now have the power to understand and negotiate better. It’s all about making the process smoother for everyone involved.

Why Commissions Matter

Real estate commissions can be a significant part of your budget. Whether you’re a first-time buyer or a seasoned seller, knowing these costs upfront is essential. These updates are designed to give you more clarity and control.

Understanding the California Housing Market

Before we dive into commissions, let’s take a quick look at the current state of the housing market in California. This context is key:

- Median Home Sale Price: $818,100

- Housing Supply: 98,013 (+21.7% YoY)

- Homes Sold Above List Price: 42.2% (-6.3 pts YoY)

The New Rules

These new rules aim to demystify the buying and selling process. Now, you don’t have to feel like you’re in the dark about where your money’s going. Transparency is the name of the game, and it’s here to help you make smarter decisions.

What Are Real Estate Commissions?

Real estate commissions are the payments made to agents when a property is sold. Typically a percentage of the sale price, these fees are settled at closing, rewarding agents for their crucial role in the transaction.

Who Pays the Commission?

Traditionally, the seller covered both the listing and buyer’s agent fees. But here’s the kicker: as of August 17, 2024, buyers must agree to their agent’s fee in writing before even stepping foot in a home. This puts power back in your hands—buyers can negotiate fees, and sellers aren’t automatically on the hook anymore.

Average Commission Rates in California

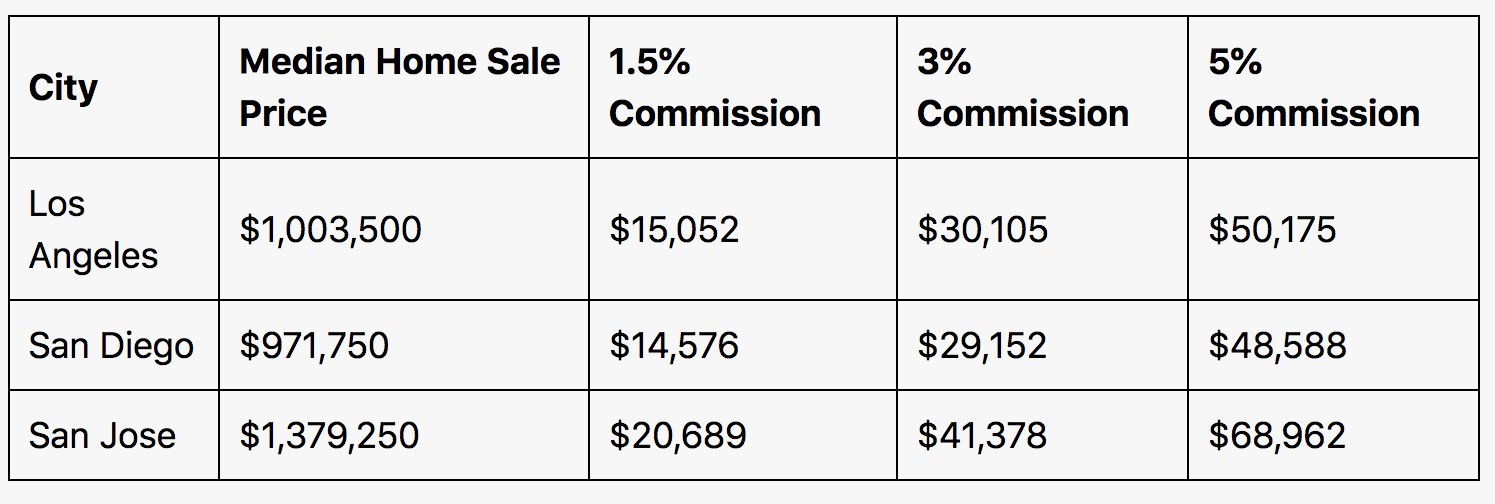

Commission rates vary widely. They’re influenced by market conditions, property location, and the agent’s services. Here’s a quick look at standard rates based on median home prices:

At Leviacore we aim to offer great value. Sellers can list for as low as 1%*, and our competitive buyer fees help make your offer stand out.

Can You Negotiate Commissions? Absolutely! There are no fixed rates, so get in there and negotiate. Consider the services offered, the agent’s expertise, and the specifics of your transaction. In dual agency situations, there might be even more room to negotiate. Tips for Successful Negotiation Interview multiple agents to compare fees and services.

Propose a performance-based fee that rewards a quicker sale.

Use your property’s desirability as leverage.

California Real Estate Commission FAQs

What are the changes?

Buyers must agree to their agent’s fee before home tours.

Buyer agent commission amounts may not be listed on the MLS.

How do changes impact buyers?

Buyers need to sign an agreement outlining agent fees. Still, they can negotiate with sellers to cover these costs.

How do changes impact sellers?

Sellers can negotiate how much to contribute towards buyer’s agent fees. Be ready to discuss costs with buyers.

How do you find an agent in California?

Partnering with the right agent is key to navigating buying or selling with expert guidance.

How can you avoid fees?

Consider the FSBO route, but remember—it’s a lot of work without professional support.

Key Takeaways

- Be Prepared: Know what commissions entail and how they fit into your overall budget.

- Negotiate: Use the new transparency to your advantage. Don’t be afraid to discuss fees with your agent.

- Stay Informed: Understanding the market trends will help you make informed decisions whether buying or selling.

Sources : Alex Harmozy, Ana de Guzman